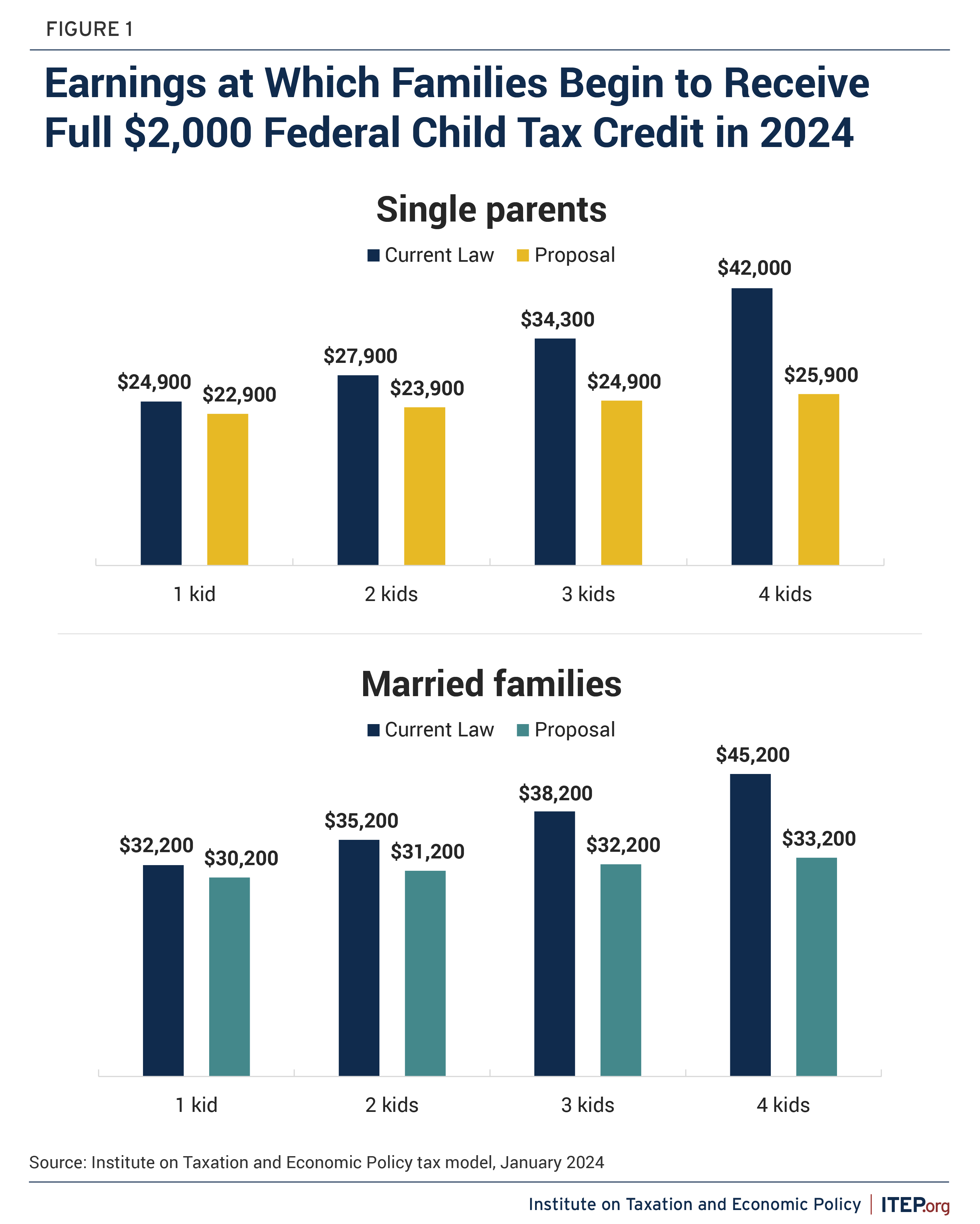

2024 Child Tax Credit Amount Increase – The proposed deal would increase the maximum refundable amount per child to $1,800 in tax year 2023, $1,900 in tax year 2024, and $2,000 in tax year 2025. Additionally, the maximum $2,000 child tax . A new tax bill aims to increase access to the child tax credit for The change would allow families with lower incomes to access a larger amount of the credit. Right now, the standard child tax .

2024 Child Tax Credit Amount Increase

Source : itep.org

Child Tax Credit Boost in USA What Can be the Increase in Child

Source : matricbseb.com

USA Child Tax Credit 2024 Increase From $1600 To $2000? Apply

Source : cwccareers.in

Child Tax Credit Boost in USA What Can be the Increase in Child

Source : matricbseb.com

Child Tax Credit Increase 2024 Amount, Eligibility and How to

Source : www.gmrit.org

Child Tax Credit Increase 2024 Full News about What can be the

Source : matricbseb.com

Proposed Tax Deal Would Help Millions of Kids with Child Tax

Source : itep.org

Child Tax Credit Increase 2024 Full News about What can be the

Source : matricbseb.com

$3600 Child Tax Credit 2024 Know Eligibility & Increase Amount Check

Source : cwccareers.in

Child Tax Credit Increase Eligibility, Amount, Payment Method

Source : www.bscnursing2022.com

2024 Child Tax Credit Amount Increase Expanding the Child Tax Credit Would Help Nearly 60 Million Kids : Low-income parents stand to benefit the most from proposed Child Tax Credit increases for the 2023 tax season — and their savings could add up to thousands depending on how many children they have. . A bipartisan bill with tax breaks for businesses and families got a boost of momentum as negotiators seek to build the support needed for it to clear Congress. .